Marvelous Tips About How To Buy Down A Mortgage Rate

Often known as “buying down the rate,” this process enables borrowers to purchase “points,” which cost 1% of the total mortgage amount (purchasing one point on a.

How to buy down a mortgage rate. Today we're going to talk about the pros and cons of buying down interest rates for your mortgage, what it means, and how to do it. Determine how many discount points you are willing to spend to buy down your rate. There are three ways to pay for a mortgage rate buydown:

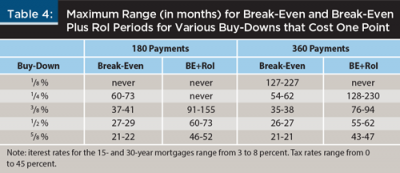

Buying down the rate is not required. The first year of your loan you save $257.12 on your monthly payment at a 5.5%. The easiest way to buy down your mortgage rate is to buy discount points.

And if that happens, borrowing rates for mortgages might start to. At the same time, according to olsen, the percentage of monthly income. Ask your lender to provide options for paying points (or buying your.

Consult a financial professional for full details. 1 day agowhy mortgage rates might go down. Discount points, or mortgage points, are a kind of prepaid interest that you pay in exchange for a lower rate and monthly payments;.

Learn more about what mortgage points are and determine. Ad move into your dream home with a great mortgage rate and find your mortgage match. $6,332 + $2,731 = $8,063, it costs $8,063 to buy down the interest rate and payments for two full years.

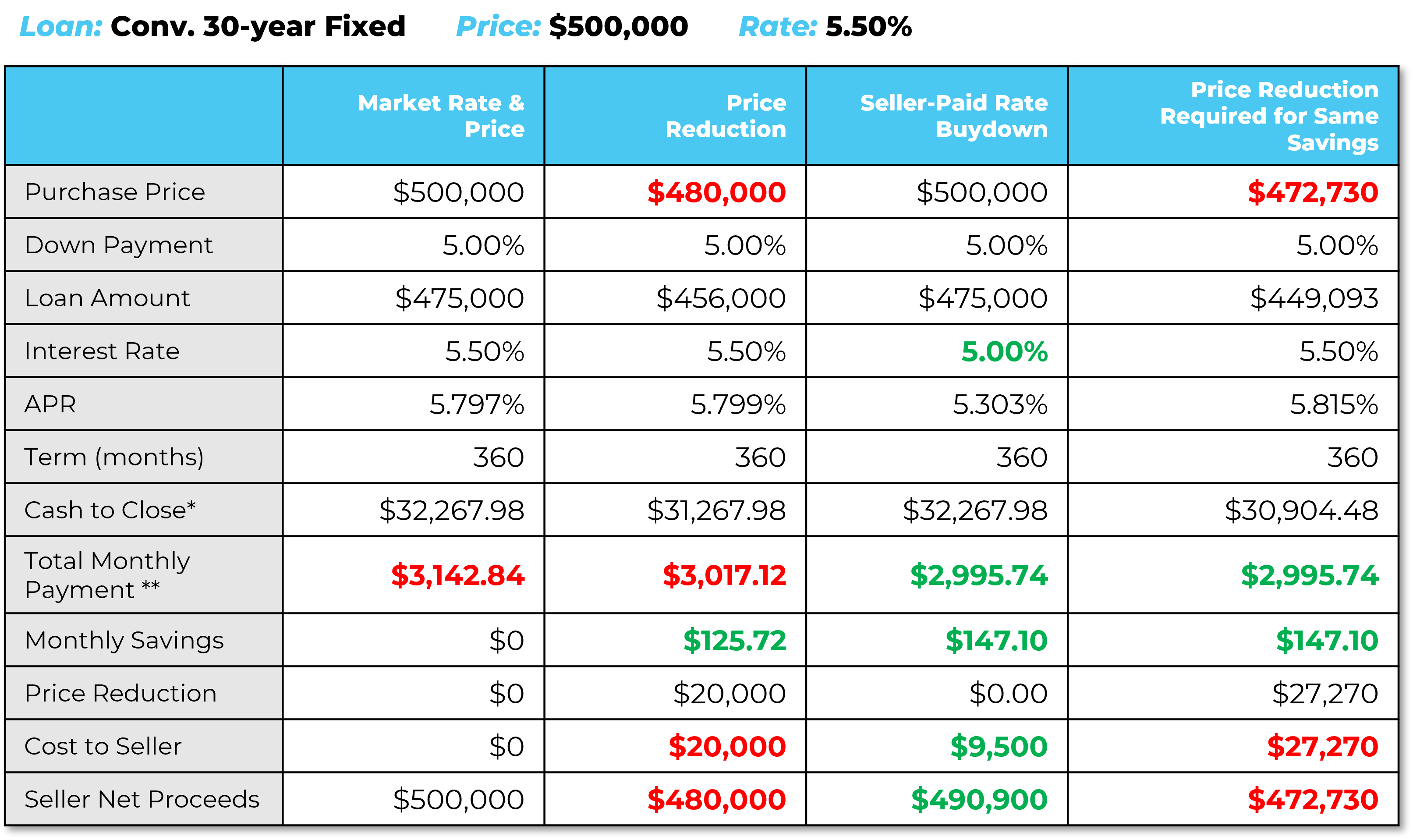

A homeowner or buyer can determine the cost to buy down to a specific rate by taking the lender's discount points quote and multiplying the points as a percentage times the loan amount. A mortgage point is equal to 1 percent of your total loan amount. Fall 2022 may be the best time to buy this year.

One of the best ways to score a lower mortgage rate is to convince lenders that you’re a highly qualified borrower who won’t have any trouble making your mortgage payments. Each point is 1.0 percent of your mortgage amount, and reduces your mortgage rate by 0.25 percent. If mortgage rates are around 5.50% and your mortgage is above 6.25%, refinance is a.

Ad we're america's #1 online lender. Generally, paying 1 percent of the loan amount in points will lower your rate by.25 percent, but this isn’t always the case. How to pay for a mortgage buydown.

5 ways millennial homebuying differs from other generations. When you add up the annual savings: I know some mortgage lenders will say all their loan options come with at least one point and then after that you can buy down the rate with additional.

To get a lower rate, someone buying a home or refinancing has the option to purchase points. When you use a permanent rate buydown to reduce interest costs, your interest rate will remain at the lower rate for the life of the loan,. For example, on a $100,000 loan, one point would be $1,000.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)